Imagine you’re finally ready to book that dream trip to Bali. You find the perfect villa, calculate the costs… and then get hit with a nasty surprise: hidden exchange rate fees that add hundreds of dollars to the price. Frustrating, right? Unfortunately, this is a common experience for anyone making international purchases, sending money abroad, or withdrawing cash while traveling. Traditional money transfer services often charge significant markups on the exchange rate, effectively taking a hidden cut of your money. However, a more innovative way to manage your international finances is to use a multi currency account. This post will explain how a multi currency account can help you avoid those exorbitant fees and keep more of your hard-earned money. We’ll focus on the benefits of a personal multi currency account for individuals like you. Let’s dive in and see how it works.

What is a Multi Currency Account?

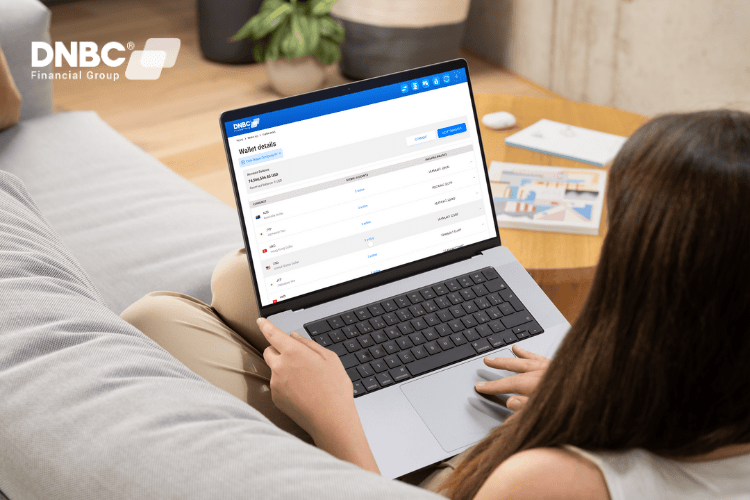

A multi currency account, sometimes called a foreign currency account, is a money transfer service account that allows you to hold, manage, and exchange multiple currencies within a single account. Think of it like having several individual currency accounts (often called “wallets” or “balances”) housed under one roof. Instead of needing separate accounts for US dollars, Euros, British pounds, and so on, you can manage them all in one convenient place.

So, how does it work? Essentially, a multi currency account provides you with the ability to:

- Hold multiple currencies: You can keep balances in various currencies simultaneously (e.g., USD, EUR, GBP, JPY, and many others, depending on the provider).

- Exchange between currencies: You can convert money between your different currency balances, often at much better exchange rates than those offered by traditional money transfer services.

- Send and receive payments internationally: You can accept payments in different currencies, often avoiding high international transfer fees.

While there are different types of multi currency accounts, including those for businesses, this article will concentrate on the advantages of a personal multi currency account designed for individual use. For example, a traveler could use a multi currency account to load Euros before a trip to Europe, avoiding costly dynamic currency conversion at the point of sale or foreign transaction fee. They could then pay for their hotel and meals directly in Euros, like a local.

The Hidden Cost of Traditional Currency Exchange

You’re likely paying much more than you realize when you use your regular money transfer service for international transactions. It’s not just about the apparent fees they might list; the real culprit is often the exchange rate. Traditional money transfer services typically don’t offer you the “real” exchange rate (the mid-market rate you see on Google or XE.com). Instead, they add a markup – a hidden percentage on top of that rate – and pocket the difference. This markup can range from 2% to 5% or even higher in some cases.

Beyond the inflated exchange rate, there are other potential fees to watch out for:

- Foreign Transaction Fees: Many money transfer services charge a fee (often 1-3%) for every transaction you make in a foreign currency, even using a credit or debit card.

- International Wire Transfer Fees: Sending money internationally through your money transfer service can be incredibly expensive, with fees ranging from $25 to $50 (or more) per transfer.

- Dynamic Currency Conversion (DCC): This is a sneaky trick where a merchant or ATM offers to charge you in your home currency instead of the local currency. While it sounds convenient, the exchange rate is almost always terrible, and you pay significant look at some real-world exyour bank samples:

- Example 1: Online Shopping: You buy a €100 jacket from a European website. With a 4% exchange rate markup, your money transfer service charges you $115 instead of the actual mid-market rate equivalent of, say, $110. You’ve lost $5 to the hidden markup.

- Example 2: Sending Money Abroad: You send $1000 to a family in Mexico. Your money transfer service charges a $40 wire transfer fee and uses a poor exchange rate, resulting in your family receiving significantly less than they should.

- Example 3: ATM Withdrawal: Withdrawing 200 in local currency while at the foreign, using an ATM, with a 3% foreign transaction fee and additional 5 dollar flat fees, will cost much more.

These small percentages add up quickly, especially for frequent travelers, online shoppers, or those supporting family overseas. You could be losing hundreds, or even thousands, of dollars per year to these hidden costs.

How a Multi Currency Account Saves You Money on Exchange Rates

A multi currency account directly addresses the costly issues of traditional currency exchange. It’s designed to give you more control and transparency, significantly reducing or eliminating those hidden fees and unfavorable exchange rates. Here’s how:

Better Exchange Rates: The most significant advantage is access to better exchange rates. Multi currency account providers often offer rates close to the mid-market rate – the “real” rate on financial websites. This means you get more of the foreign currency for your money. The spread (the difference between the buy and sell rate) is typically much smaller than traditional money transfer services.

Lower (or No) Fees: Many personal multi currency accounts have significantly lower fees for international transactions. Some providers even offer fee-free currency conversions up to a specific limit. International transfers are often much cheaper, sometimes even free, compared to the hefty fees charged by traditional money transfer services.

Transparency is Key: With a multi currency account, you see the exchange rate and any applicable fees before you commit to a transaction. There are no hidden surprises. You know exactly how much you’re paying and how much the recipient will receive.

Greater Control: You gain more control over your currency exchange:

- Lock-in Rates: Some providers allow you to “lock in” a favorable exchange rate when you see one, even if you don’t need to use the funds immediately. This is particularly useful during periods of currency volatility.

- Choose Your Timing: You can decide when to convert your currency rather than being forced to accept whatever rate your money transfer service offers during a transaction.

- Avoid DCC: By holding balances in different currencies, you can avoid Dynamic Currency Conversion altogether, paying in the local currency and getting the best possible rate.

Let’s revisit those examples from before:

- Online Shopping: With a multi currency account, you could have loaded Euros onto your account beforehand at a near mid-market rate, paying close to the actual $110 equivalent for that €100 jacket, saving the $5 markup.

- Sending Money Abroad: You could have sent the $1000 to your family with significantly lower (or even zero) transfer fees, and they would have received much closer to the full value in their local currency.

- ATM Withdrawal: Using a dedicated multi-currency card linked to your account, you can withdraw in a foreign currency without additional fees or significantly reduced costs.

A multi currency account puts you back in control of your international finances, empowering you to save money and avoid the hidden costs of traditional money transfer services.

Beyond Exchange Rates: Other Advantages of a Personal Multi Currency Account

While saving money on exchange rates is a major draw, a personal multi currency account offers a range of other benefits that make managing your international finances more straightforward and convenient.

- Convenience: Having all your different currency balances in one place simplifies your financial life. No more juggling multiple money transfer service accounts or mental calculations to track your money across various currencies. You get a clear, consolidated view of your holdings.

- Simplified International Payments: Sending and receiving money internationally becomes much smoother. You can quickly pay overseas suppliers, receive payments from international clients, or send money to family abroad, all within the same account.

- Travel Benefits: A personal multi currency account is a traveler’s best friend. Avoid foreign transaction fees on your card purchases, withdraw cash at ATMs with better rates, and carry multiple currencies without the hassle of exchanging physical cash. Some accounts even offer travel-related perks like travel insurance or airport lounge access.

- Freelancer/Business Advantages (Briefly): Even if you’re not running a full-fledged business, a personal multi currency account can be invaluable if you freelance or have side hustles with international clients. It simplifies invoicing, receiving payments in different currencies, and managing income streams.

- Speed: Currency conversions are swift and sometimes even immediate. This means you can react to market change and transfer or pay anytime.

- Security: A reputable provider will ensure the safekeeping of your funds; often, they are backed up to a certain amount by the government.

These added conveniences make a personal multi currency account a powerful tool for anyone who regularly deals with multiple currencies, whether for travel, work, or personal finance.

Choosing the Right Multi Currency Account for Your Needs

With a growing number of providers offering multi currency accounts, choosing one that best suits your requirements is essential. Consider these key factors:

- Fees and exchange rates: Compare the exchange rate markups and associated fees (monthly, transaction, etc.).

- Supported currencies: Ensure the account supports the currencies you use most frequently.

- Features: Look for features that are relevant to you, such as a linked debit card, virtual cards, budgeting tools, or travel perks.

- Ease of use: The platform should be user-friendly and intuitive.

- Customer support: Check the availability and responsiveness of customer support.

- Security and Regulation: Choose a reputable and regulated provider to ensure the safety of your funds.

Take your time to research and compare different multi currency account options before making a decision.

Conclusion

In conclusion, high exchange rate fees and hidden charges from traditional money transfer services can significantly eat into your money when dealing with international transactions. A multi currency account offers a powerful solution, providing better exchange rates, lower fees, and greater control over your finances. Beyond saving money, it provides convenience, simplifies international transfers, and benefits travelers, freelancers, and anyone managing multiple currencies. If you’re ready to take control of your global finances and experience genuinely personal service, consider opening a multi currency account with DNBC Financial Group. DNBC offers competitive exchange rates, transparent fees, and a dedicated team to support your individual needs, making international finance more straightforward and affordable. Explore the options at DNBC Financial Group and start saving today!

DNBC Financial Group is your trusted provider in international money transfer

- Get 100% free 1-on-1 support

- 100% free account opening

- Seamless onboarding process

Or please contact DNBC

![]() Email: [email protected]

Email: [email protected]

![]() Phone Number:

Phone Number:

- +65 6572 8885 (Office)

- +1 604 227 7007 (Hotline Canada)

- +65 8442 3474 (WhatsApp)

DNBC Team

DNBC Team