The automotive world is undergoing a seismic shift, fueled by a growing awareness of climate change and a global push to reduce carbon emissions. One of the key mechanisms driving this change is a system you might not be familiar with: carbon tax credit trading. This intricate system is quietly reshaping the industry, pushing automakers to accelerate the development and production of electric vehicles (EVs). But what does this mean for the average consumer? Could carbon tax credit trading ultimately impact your next car trade-in? This article will dive into the basics of this often-misunderstood system, explore its powerful influence on the automotive market’s embrace of EVs, and examine its potential, though indirect, implications for the used car market and the tax credit when trading in a car for an EV. While the future remains to be written, understanding carbon tax credit trading is crucial to grasping the forces driving the ongoing transformation of the automotive landscape. Who does carbon tax affect the most? We’ll take a look at that, too.

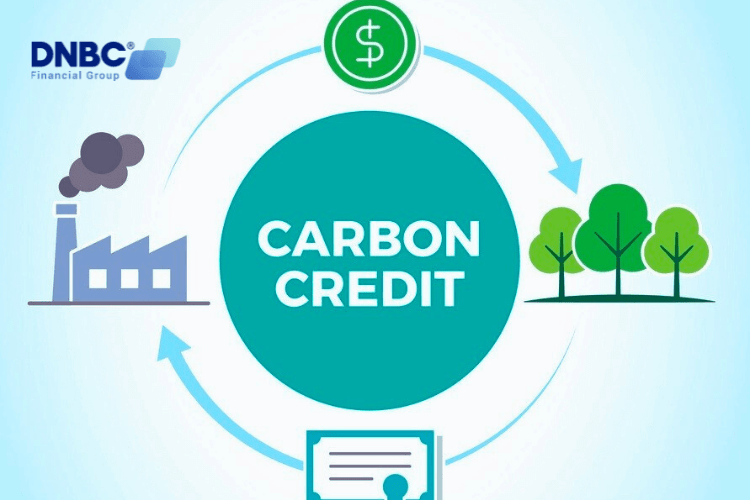

Understanding Carbon Tax Credit Trading

What is Carbon Tax Credit Trading?

At its core, carbon tax credit trading is a market-based approach designed to reduce greenhouse gas emissions, particularly carbon dioxide, a major contributor to climate change. It’s a system where carbon is priced, creating a financial incentive for companies to lower their emissions. Governments or regulatory bodies set a limit, or “cap,” on the total amount of greenhouse gases that certain industries can emit within a specific timeframe. Companies that pollute less than their allowed limit earn carbon credits. Each credit typically represents one metric ton of carbon dioxide equivalent (CO2e) that wasn’t emitted.

A Simple Analogy

Imagine a school where students are given several “free passes” to be late to class. If a student is always on time, they don’t use their passes and can sell their extra passes (credits) to students who are frequently late. Late students must buy these passes (credits) or face a penalty. Similarly, in carbon tax credit trading, companies that reduce their emissions below the set limit can sell their extra credits to companies that exceed their limit.

The Purpose of the System

Carbon tax credit trading aims to incentivize businesses to invest in cleaner technologies and practices. The system encourages innovation and a shift towards a lower-carbon economy by making it more expensive to pollute and financially rewarding to reduce emissions. It aims to achieve overall emission reduction targets in an economically efficient way, allowing the market to determine the most cost-effective ways to cut pollution.

How It Works in Practice

The process of carbon tax credit trading generally involves these key steps:

- Setting the Cap: A regulatory authority limits emissions for a specific period.

- Allocating or Auctioning Credits: Credits are either allocated to companies based on their historical emissions or auctioned off.

- Emissions Monitoring and Reporting: Companies must accurately monitor and report their emissions to the regulatory body.

- Trading Credits: Companies that emit less than their allowance can sell their surplus credits on a carbon market. Companies exceeding their limit must purchase credits to cover the excess emissions.

- Compliance and Enforcement: Companies that fail to comply with the regulations face penalties, such as fines or other enforcement actions.

The market price of carbon credits fluctuates based on supply and demand, creating a dynamic system that reflects the cost of reducing emissions. As the overall cap is gradually reduced over time, the supply of credits decreases, theoretically driving up the price and further incentivizing emission reductions. In the next section, we’ll see how this system profoundly impacts the automotive industry’s move toward electric vehicles.

The Auto Industry’s Role in Carbon Tax Credit Trading

Driving Change: How Automakers Use Carbon Tax Credits

The automotive industry is a significant carbon tax credit trading player. Stringent fuel efficiency standards and emissions regulations, such as the Corporate Average Fuel Economy (CAFE) standards in the United States and similar regulations like the Euro emissions standards in Europe, are pushing automakers to reduce their vehicles’ carbon footprint drastically. In the U.S., for example, the Inflation Reduction Act has provisions to use government procurement to support low-carbon production in several industries. These regulations often incorporate mechanisms directly tied to carbon tax credit trading.

Earning Credits Through Cleaner Cars

Automakers earn carbon credits primarily by manufacturing and selling vehicles that emit less carbon dioxide than the regulatory limits. This means that electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and, to a lesser extent, highly fuel-efficient gasoline vehicles contribute to a manufacturer’s credit pool. The more zero-emission vehicles they sell, the more credits they accumulate. Each EV sold can generate significant credits due to its zero tailpipe emissions.

The Trading Game: Buying and Selling Credits

The carbon tax credit trading system allows automakers with a surplus of credits to sell them to other manufacturers who are falling short of their emission targets. For instance, a company like Tesla, which exclusively produces EVs, has historically generated an enormous surplus of credits. They can sell these credits to traditional automakers with a higher proportion of gasoline-powered vehicles in their fleets and struggling to meet the increasingly strict emissions standards. This trading creates a significant revenue stream for companies ahead of the EV adoption curve. For example, Tesla has made billions of dollars selling regulatory credits to other automakers.

Financial Incentives Drive Strategic Shifts

The financial implications of carbon tax credit trading are substantial. Selling credits can generate significant revenue while having to buy credits can be a costly penalty. This dynamic is heavily influencing automakers’ strategic decisions, leading to:

- Accelerated EV Development: Automakers are pouring billions of dollars into research, development, and production of EVs to earn more credits and avoid penalties.

- Investment in Battery Technology: The value of credits drives investments in battery technology, charging infrastructure, and other EV-related technologies.

- Shifting Production Priorities: Some manufacturers may choose to discontinue or limit the production of high-emission vehicles to improve their overall emissions performance.

A Competitive Edge

In this new landscape, earning and managing carbon credits effectively is becoming a key competitive advantage. Companies that successfully navigate the complexities of carbon tax credit trading are better positioned for long-term growth and profitability as the world transitions to a lower-carbon transportation future. The next section will explore how these changes make EVs more attractive to consumers.

The Electric Vehicle Boom and Consumer Incentives

The Rise of Electric Vehicles: How Carbon Credits Are Making EVs More Appealing

The ripple effects of carbon tax credit trading significantly contribute to the accelerating growth of the electric vehicle (EV) market. As we’ve seen, automakers are heavily incentivized to produce and sell more EVs to earn valuable carbon credits. This has led to a surge in the number of EV models available, increased competition, and rapid advancements in EV technology. But how does this translate to benefits for consumers?

Potential for Lower EV Prices

While the economics are complex, the revenue generated by automakers from selling carbon credits could contribute to making EVs more affordable. This extra income stream might allow manufacturers to offer EVs at more competitive prices than similar gasoline-powered vehicles. However, it’s crucial to understand that numerous factors influence vehicle pricing, including battery costs, production scale, market demand, and overall economic conditions. Carbon credits make it possible for manufacturers to sell a greater variety of EVs and sell them in more markets.

Tax Credit When Trading in a Car: A Separate but Related Incentive

Here, it’s important to distinguish between the behind-the-scenes workings of carbon tax credit trading and the direct incentives available to consumers. When discussing a tax credit when trading in a car, we primarily refer to government-backed programs to encourage EV adoption. For example, in the United States, the federal government offers a significant tax credit of up to $7,500 for purchasing a qualifying new EV, and the Inflation Reduction Act also added a tax credit for used EVs. Some states and local jurisdictions offer additional incentives, such as rebates or tax breaks. These programs can substantially reduce the upfront cost of an EV, making them more accessible to a broader range of buyers. Some states also have programs specifically for trading in an older vehicle.

Improved EV Technology and Infrastructure

Beyond pricing, the increased focus on EVs, driven partly by carbon tax credit trading, fosters rapid innovation. We’re seeing continuous improvements in:

- Battery Technology: Longer ranges, faster charging times, and improved battery lifespans.

- Charging Infrastructure: A growing network of public charging stations, making it more convenient to charge EVs on the go.

- Vehicle Performance: EVs are often praised for their quick acceleration and responsive handling.

These advancements, coupled with the potential for lower prices and the availability of direct consumer tax credits, are making EVs an increasingly attractive option for many car buyers. As the EV market continues to mature, fueled by regulatory pressures and consumer demand, the transition to electric mobility is expected to accelerate.

Carbon Tax Credit Trading: The Indirect Effect on Trade-Ins

Could Carbon Tax Credit Trading Affect Your Car Trade-In Value?

While carbon tax credit trading significantly influences the new car market and the rise of electric vehicles, its impact on used car trade-in values is much more indirect and, at this point, largely speculative. It’s crucial to approach this topic with nuance and avoid making definitive predictions. The used car market is a complex ecosystem influenced by many factors, making it difficult to isolate the specific effects of carbon policies.

Potential Scenarios and Market Uncertainties

Several potential scenarios could unfold in the coming years, but their impact on trade-in values remains uncertain:

- Increased Demand for Used EVs: As the supply of new EVs grows, driven by factors including carbon tax credit trading, the used EV market will likely expand as well. This could affect the trade-in values of older EV models, but the extent of this impact is difficult to predict. The EV tax credit used will also have an effect.

- Shifting Demand for Gas-Powered Vehicles: In the long term, if the demand for gasoline-powered vehicles decreases significantly due to the widespread adoption of EVs, it could affect their resale values, including trade-ins. However, this is a gradual process, and the timeline for such a shift is highly uncertain. There will still be gasoline-powered vehicles on the road and a market for them for many years.

- Market Volatility: The used car market is notoriously volatile, influenced by factors like supply chain disruptions, economic downturns, consumer preferences, and technological advancements, which can have a more immediate and significant impact on trade-in values than carbon policies.

Regional Variations and Other Factors

It’s also important to note that the effects on trade-in values could vary considerably by region. Areas with higher EV adoption rates and stricter emissions regulations might experience more pronounced changes in their used car markets than regions with slower EV uptake.

Ultimately, traditional factors will likely continue to play the most significant role in determining trade-in values for the foreseeable future:

- Vehicle Make, Model, Year, and Condition: These are the primary drivers of a vehicle’s value.

- Mileage: Higher mileage typically translates to a lower trade-in value.

- Overall Market Demand: The general demand for specific makes and models greatly influences their resale value.

While the long-term effects of carbon tax credit trading on the used car market remain to be seen, it’s a topic worth monitoring as the automotive landscape continues to evolve.

Conclusion

In conclusion, carbon tax credit trading is a powerful force reshaping the automotive industry, accelerating the shift to electric vehicles. While its impact on your next car trade-in remains uncertain, the system’s influence on the availability and potentially the affordability of EVs is undeniable. As carbon policies evolve, staying informed about these changes will be increasingly important for consumers and businesses. The transition to a lower-carbon future is underway, and understanding mechanisms like carbon tax credit trading is key to navigating this evolving landscape.

DNBC Financial Group is your trusted provider in international money transfer

- Get 100% free 1-on-1 support

- 100% free account opening

- Seamless onboarding process

Or please contact DNBC

![]() Email: [email protected]

Email: [email protected]

![]() Phone Number:

Phone Number:

- +65 6572 8885 (Office)

- +1 604 227 7007 (Hotline Canada)

- +65 8442 3474 (WhatsApp)

DNBC Team

DNBC Team