Your credit score is more than just a number; it’s a key to financial chances. Whether you’re looking to secure a loan, rent a home, or qualify for the best interest rates, improving your credit score is essential.

Building and boosting your credit score can open financial opportunities and save you thousands in interest rates.

If you’re asking yourself, “How can I build my credit score?” This guide provides actionable steps backed by statistics to help you improve your financial health.

Why does a good credit score matter?

A credit score is a numerical representation of your creditworthiness, reflecting your ability to manage debt responsibly. It’s a crucial financial metric that can significantly impact your financial life.

A strong credit score can open a world of financial opportunities:

Lower interest rates: Lenders often reward individuals with good credit scores by offering lower interest rates on loans, credit cards, and mortgages. This can save you thousands of dollars over time.

Easier approval for loans & credit cards: A good credit score increases your chances of getting approved for loans and credit cards. Lenders view individuals with strong credit histories as reliable borrowers.

Improved financial opportunities: A good credit score can open doors to various financial opportunities, including:

- Rental apartments: Landlords often check credit scores to assess potential tenants’ reliability.

- Job offers: Some employers may consider credit scores as part of their hiring process, especially for positions that involve handling finances.

- Insurance policies: A good credit score can sometimes lead to lower insurance premiums.

Peace of mind: Knowing that you have a strong credit history can provide a sense of financial security and reduce stress.

What can I do to boost my credit score?

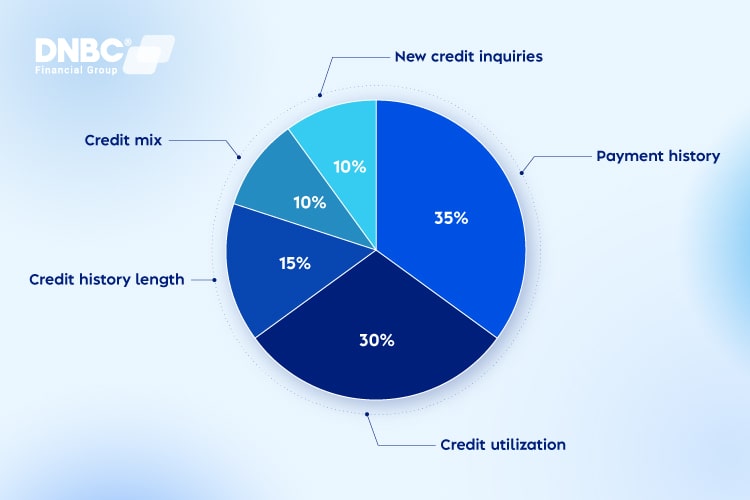

To build your credit score, you need to understand its components:

- Payment history (35%): Late or missed payments can greatly harm your score.

- Credit utilization (30%): The percentage of available credit you’re using; aim to keep it below 30%.

- Credit history length (15%): Older accounts positively impact your score.

- Credit mix (10%): A variety of accounts (credit cards, loans) shows financial stability.

- New credit inquiries (10%): Too many applications can lower your score temporarily.

1. Always pay bills on time

Your payment history has the biggest impact on your credit score. Even one missed payment can cause your score to drop. Set reminders or automate payments to ensure you never miss a due date.

If you’re behind on payments, catching up as soon as possible can help repair your score over time.

2. Lower your credit utilization ratio

Using more than 30% of your available credit limits can hurt your score. For example, if you have a $10,000 credit limit, aim to keep your balance below $3,000.

Credit utilization is the second most influential factor in your credit score. To boost your score:

- Pay down your balances regularly.

- Request a credit limit increase (but avoid overspending).

- Spread expenses across multiple cards if possible.

3. Check your credit report for errors

A 2022 FTC study found that 1 in 5 consumers had errors on their credit report. Errors on your credit report could be dragging your score down.

Look for inaccuracies such as incorrect balances or accounts that don’t belong to you, and dispute them promptly.

| Improvement step | Potential point increase |

| Paying all bills on time | 50-100 points |

| Reducing credit usage | 30-50 points |

| Removing errors | 25-50 points |

4. Limit new credit applications

Each time you apply for credit, a hard inquiry is recorded on your report, which may lower your score slightly.

To build your credit score effectively:

- Avoid opening multiple accounts in a short period.

- Only apply for credit when necessary.

5. Maintain old credit accounts

The length of your credit history contributes to your overall score. Keep your oldest accounts open to show lenders that you have a long-standing track record of responsible credit use.

6. Diversify your credit mix

Lenders prefer to see a mix of credit types, such as credit cards, personal loans, and car loans. If you only have one type of credit, consider adding another responsibly to improve your credit profile.

Having both installment loans (e.g., car loans) and revolving credit (e.g., credit cards) can boost your score by 10%.

7. Become an authorized user

If an individual with excellent credit adds you as an authorized user on their account, their positive payment history can benefit your credit score. This is a good way to boost your score, especially for those with limited credit history.

Improving your credit score is a gradual process that requires consistency. By managing your credit and addressing any negative factors, you can greatly enhance your financial health.

The next time you ask yourself, “How can I build my credit score?”, remember that every step you take brings you closer to financial freedom.

FAQs on how to build my credit score

1. How long does it take to build a good credit score?

Building a good score typically takes 6-12 months of consistent positive

behavior.

2. Does checking my credit score lower it?

No, checking your score through soft inquiries won’t affect it.

3. What is the fastest way to boost my score?

Paying down credit card balances and disputing errors are the quickest

methods.

4. Can I build credit without a credit card?

Yes, by using tools like credit-builder loans or reporting rent payments.

5. Is 700 a good credit score?

Yes, a score of 700 is considered “good” and qualifies for favorable loan

terms.

DNBC Financial Group is your trusted provider in international money transfer

- Get 100% free 1-on-1 support

- 100% free account opening

- Seamless onboarding process

Or please contact DNBC

![]() Email: support@dnbcgroup.com

Email: support@dnbcgroup.com

![]() Phone Number:

Phone Number:

- +65 6572 8885 (Office)

- +1 604 227 7007 (Hotline Canada)

- +65 8442 3474 (WhatsApp)

DNBC Team

DNBC Team