By clicking "Accept All Cookies", you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Lear more.

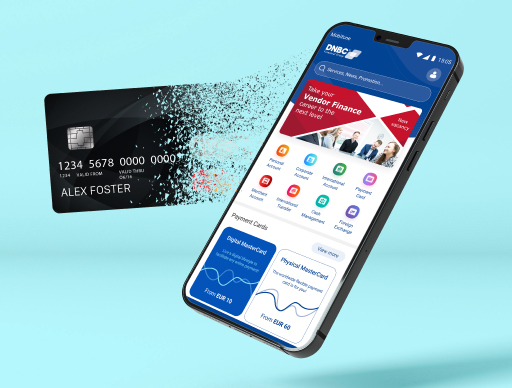

Unlock a World of Convenience with DNBC Prepaid Card

Your card, your lifestyle. Make payments worldwide with confidence.

Your Key to Financial Freedom, Online & Offline

Embrace a new era of convenience with the DNBC Prepaid Card, your passport to secure and seamless transactions, anytime, anywhere.

Designed for the modern lifestyle, it puts you in control of your money whether you're shopping, booking trips, or dining out.

It's more than a card; it's your gateway to a hassle-free life.

Elevate Your Lifestyle with DNBC Prepaid Card!

Convenience, Security, and Freedom, All in One Card.

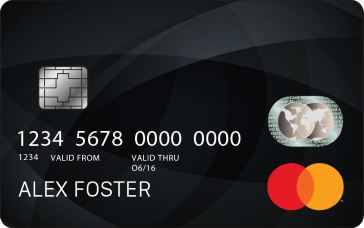

Swift and Secure Payments: Enjoy hassle-free transactions with contactless and EMV chip technology. Quick, secure, and perfect for your on-the-go lifestyle.

Round-the-Clock Protection: 24/7 fraud monitoring to keep your funds safe and your mind at ease.

Global Acceptance: Your perfect travel companion, accepted worldwide with MasterCard recognition.

Multi-Currency Freedom: Say goodbye to currency worries. Pay in multiple currencies effortlessly.

DNBC Prepaid Card - Your gateway to a world of convenience, security, and freedom.

Convenience, Security, and Freedom, All in One Card.

Swift and Secure Payments: Enjoy hassle-free transactions with contactless and EMV chip technology. Quick, secure, and perfect for your on-the-go lifestyle.

Round-the-Clock Protection: 24/7 fraud monitoring to keep your funds safe and your mind at ease.

Global Acceptance: Your perfect travel companion, accepted worldwide with MasterCard recognition.

Multi-Currency Freedom: Say goodbye to currency worries. Pay in multiple currencies effortlessly.

DNBC Prepaid Card - Your gateway to a world of convenience, security, and freedom.

Your DNBC Prepaid Card is more than a card; it's your trusted travel companion, offering seamless transactions wherever you go.

Plastic Prepaid Card: Travel with Confidence

Discover a world of convenience with DNBC Plastic Prepaid Card:

- Multiple Payment Options: In-person, online, via POS, over the phone or in-app.

- Contactless Payments: Speedy transactions with a simple tap.

- Worldwide Acceptance: Use your card anywhere around the globe.

- Easy Money Management: Access funds via ATMs, Apps, or online payment portal.

- 3-Year Validity: Enjoy long-term convenience

DNBC Virtual Prepaid Card: Your Gateway to Secure Online Transactions!

Experience the new wave of payment with DNBC Virtual Prepaid Card. A virtual card that guarantees secure, real-time online transactions, anytime, anywhere. Say goodbye to the fears of card loss or theft:

- Enjoy borderless payments

- Shop online in real-time

- Secure your bookings for accommodations and tours

- Enhanced security with virtual card digits and CVV code

- 12-month Validity: Enjoy long-term convenience.

It's more than just a virtual card; it's your key to a world of secure, convenient, and quick online transactions. Embrace the future, embrace convenience with DNBC Virtual Prepaid Card.

How It Works:

Your Simple 3-Step Guide to

DNBC Prepaid Card

Unlock the world of convenience in just three simple and quick steps.

Apply for a Card

Get started by opening a DNBC personal account.

First, you need a DNBC personal account. If you don’t have one, open it here. Once you have an account, apply for your Plastic or Virtual Prepaid Card through DNBC website or app.

Manage Your Card

Activate, set up, and fund your card.

Once you have your card, activate it, set up your preferences, and top up funds all via the DNBC website or app. This includes enabling transaction alerts and other settings.

Start Using Your Card

Start Using Your Card

With your card ready, you can withdraw funds, make online and offline payments, and view your statements.

Card Fees and Limits

DNBC Prepaid Card

Experience global convenience with our prepaid card!

| Service Name | Amount |

|---|---|

| Monthly fee | 13 GBP 15 EUR 22 CAD 15 CHF |

| Card opening fee | 43 GBP 49 EUR 70 CAD 49 CHF |

| Card delivery fee (DHL, Courier) *DHL arrives within 1-2 days, tracking available |

52 GBP 59 EUR 85 CAD 59 CHF |

| Card delivery fee (Standard Mail) *Normally arrives within 14-21 days |

4.5 GBP 5 EUR 7.5 CAD 5 CHF |

| POS Purchases (Domestic) | 1.99 GBP 1.99 EUR 4.99 USD |

| POS Purchases (International) | 4.99 GBP 4.99 EUR 4.99 USD |

| Foreign exchange fee | 4.99% GBP 4.99% EUR 4.99% USD |

| Full KYC review fee | 5.49 GBP 5.99 EUR 8.99 CAD 5.99 CHF |

| PIN retrieval fee | 8.99 GBP 9.99 EUR 14.99 CAD 9.99 CHF |

| Card activation (via the Internet) | Free of charge |

| Fund loading to card (GBP / EUR) | 2%, min 3 GBP / 5 EUR / 7 CAD / 5 CHF |

| Fund loading to card (USD) | 4%, min 6 GBP / 10 EUR / 14 CAD / 10 CHF |

| Service Name | Amount |

|---|---|

| Cash withdrawal fee (domestic) | 7.99 GBP 7.99 EUR 1.90% + 7.99 USD |

| Cash withdrawal fee (International) | 1.90% + 7.99 GBP 1.90% + 7.99 EUR 1.90% + 7.99 USD |

| ATM/cash withdrawals decline fee | 0.55 GBP 0.55 EUR 0.55 USD |

| ATM balance inquiry | 1 GBP 1 EUR 1 USD |

This table is for Full KYC:

| Service Name | Limited Amount | |||||

|---|---|---|---|---|---|---|

| USD | EUR | GBP | ||||

| POS single transaction limit | 20,000 | 20,000 | 20,000 | |||

| POS daily spend limit (20 transactions per day) | 20,000 | 20,000 | 20,000 | |||

| ATM single withdrawal limit | 600 | 500 | 400 | |||

| ATM daily withdrawal limit (5 transactions per day) | 3,000 | 2,500 | 2,000 | |||

| Single load limit | 6,000 | 5,000 | 5,000 | |||

| Daily load limit (10 transactions per day) | 6,000 | 5,000 | 5,000 | |||

| Monthly load limit | 20,000 | 20,000 | 20,000 | |||

| Yearly load limit | 80,000 | 80,000 | 80,000 | |||

| Maximum card balance | 20,000 | 20,000 | 80,000 | |||

This table is for Basic KYC:

| Service Name | Limited Amount | |||||

|---|---|---|---|---|---|---|

| USD | EUR | GBP | ||||

| POS single transaction limit | 300 | 250 | 200 | |||

| POS daily spend limit (10 transactions per day) | 300 | 250 | 200 | |||

| ATM single withdrawal limit | 150 | 100 | 80 | |||

| ATM daily withdrawal limit (5 transactions per day) | 150 | 100 | 80 | |||

| Single load limit | 300 | 250 | 200 | |||

| Daily load limit (10 transactions per day) | 300 | 250 | 200 | |||

| Monthly load limit | 300 | 250 | 200 | |||

| Yearly load limit | 300 | 250 | 200 | |||

| Maximum card balance | 300 | 250 | 200 | |||

| Service Name | Limited Amount | ||

|---|---|---|---|

| POS single transaction limit | |||

| USD | |||

| 20,000 | |||

| EUR | |||

| 20,000 | |||

| GBP | |||

| 20,000 | |||

| POS daily spend limit (20 transactions per day) | |||

| USD | |||

| 20,000 | |||

| EUR | |||

| 20,000 | |||

| GBP | |||

| 20,000 | |||

| ATM single withdrawal limit | |||

| USD | |||

| 600 | |||

| EUR | |||

| 500 | |||

| GBP | |||

| 400 | |||

| ATM daily withdrawal limit (5 transactions per day) | |||

| USD | |||

| 3,000 | |||

| EUR | |||

| 2,500 | |||

| GBP | |||

| 2,000 | |||

| Single load limit | |||

| USD | |||

| 6000 | |||

| EUR | |||

| 5000 | |||

| GBP | |||

| 5000 | |||

| Daily load limit (10 transactions per day) | |||

| USD | |||

| 6000 | |||

| EUR | |||

| 5000 | |||

| GBP | |||

| 5000 | |||

| Monthly load limit | |||

| USD | |||

| 20,000 | |||

| EUR | |||

| 20,000 | |||

| GBP | |||

| 20,000 | |||

| Yearly load limit | |||

| USD | |||

| 80000 | |||

| EUR | |||

| 80000 | |||

| GBP | |||

| 80000 | |||

| Maximum card balance | |||

| USD | |||

| 20,000 | |||

| EUR | |||

| 20,000 | |||

| GBP | |||

| 80000 | |||

Note: While waiting for your plastic card to be issued, please refer to the card limit table below.

| Service Name | Limited Amount | ||

|---|---|---|---|

| POS single transaction limit | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| POS daily spend limit (20 transactions per day) | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| ATM single withdrawal limit | |||

| USD | 150 | ||

| EUR | 100 | ||

| GBP | 80 | ||

| ATM daily withdrawal limit (5 transactions per day) | |||

| USD | 150 | ||

| EUR | 100 | ||

| GBP | 80 | ||

| Single load limit | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| Daily load limit (10 transactions per day) | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| Monthly load limit | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| Yearly load limit | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 20 | ||

| Maximum card balance | |||

| USD | 300 | ||

| EUR | 250 | ||

| GBP | 200 | ||

| Details | Amount |

| Card closing fee | Free of charge |

| Balance between >10 and <=100 | 10 GBP / EUR / USD |

| Balance between >100 and <=2,500 | 50 GBP / EUR / USD |

| Balance >2,500 | 2% / total balance |

| Note: It's advisable to spend all remaining balances on your card before closing. |

|

Note:

Note:

- - The DNBC Prepaid Card is available to citizens of select EU/EEA countries or individuals residing within these EU/EEA countries. Specifically, this includes: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the UK.

- - The validity term of the plastic card is 3 years.

- - The validity term of the virtual card is 12 months.

Information updated as of January 6th, 2024. The fees and charges are subject to change from time to time.

Don’t just take our word for it

Unlock your freedom with a card that caters to your needs

Frequently Asked Questions

Yes, acquiring a DNBC Prepaid card comes with certain fees, but rest assured, there are no hidden charges.

For a detailed breakdown of these fees, please refer to the “Card Issuance Fee” section on our website.

You can definitely have multiple cards in different currencies with DNBC Prepaid Card. Our cards are available in three different currencies: EUR, USD, and GBP. However, it’s important to note that the currency associated with your card might not necessarily match the currency of your DNBC account.

For example, you have the option to request a card in USD for your transactions, while your DNBC account may remain in EUR for payment transfer services. This flexibility allows you to manage your finances conveniently in multiple currencies, catering to your specific needs.

You can apply for a prepaid card through the following methods:

- Online Application: Visit our DNBCnet portal. Complete the application form and upload the requisite documents for expedited review.

- Email Support: Initiate your application by sending a request to [email protected]. Our team will subsequently guide you through the necessary procedures.

- Relationship Manager: Should you desire a more tailored experience, your Relationship Manager is ready to assist in the card application journey.

If your PIN is compromised, it’s recommended to get a new card instead of changing the PIN. Immediately report the issue to DNBC. We will handle the reissue, providing you with a card that retains your details and balance but with new security credentials.

To recharge your DNBC prepaid card, follow the streamlined steps below through the DNBCnet portal:

- Ensure your linked DNBC current account has sufficient funds.

- Visit: DNBCnet Login at: https://secure.dnbcnet.com/login

- Navigate to “Account/Card details” and select “Top-up”.

- In the ‘Input’ section:

- + Choose the funding account.

- + If you possess multiple cards, select the desired prepaid card.

- + Input the top-up amount and currency.

- + Note: A variable top-up fee will display based on the top-up amount.

- During the “Review” phase:

- + Pick your preferred OTP delivery method (SMS or Email).

- + Click “Confirm”.

- In the “Verify” phase, input the received OTP code.

- Upon completion, funds will instantly reflect on your prepaid card.

If you encounter any difficulties or have questions, don’t hesitate to email our Customer Service team at [email protected] for assistance.

You can use the DNBC Prepaid card at a multitude of merchant locations worldwide, both online and in-person, wherever you see the MasterCard logo. This encompasses venues like restaurants, hotels, retail stores, and gas stations. Moreover, the card is suitable for online purchases and service bookings. For cash withdrawals, simply visit any ATM with the MasterCard signage. Please note the specific withdrawal limits detailed in our ATM withdrawal guidelines.

No, the card balance operates independently and is not directly linked to your DNBC account. If you exhaust the funds on your card, you have to top it up to use it. The specific top-up procedure is as follows:

- Log in to your account via the DNBCnet portal.

- Navigate to the ‘Top-Up’ function.

If you encounter any difficulties or have questions about topping up, please email our Customer Service team at [email protected] for assistance.

In the unfortunate event that your card goes missing or is stolen, it’s essential to act quickly to safeguard your funds:

Immediate Self-Service: To ensure immediate security, we highly recommend using the DNBCnet portal to utilize the “Suspend Card” feature, which will deactivate your card instantly.

Contact DNBC: If needed, you can also reach out to us directly via our hotline or email. However, please be aware of potential timezone differences that might cause delays. Therefore, we strongly advise suspending your card immediately through the self-service option on DNBCnet.

Your financial security is our priority, so take swift action to ensure the safety of your funds.

Yes, there is a dedicated website for managing your DNBC prepaid card:

DNBCnet Portal: By accessing our web portal, you’ll have a comprehensive overview of your card transactions and settings. Simply log in through the DNBCnet website. The portal is designed for a secure and user-friendly card management experience.

If you require assistance or encounter issues with your card, here’s how you can get in touch with DNBC:

- Email: Reach out to our Customer Service team by sending your inquiries or concerns to [email protected]. We strive to respond promptly.

- Hotline: For immediate assistance, dial our dedicated card support number at +65 6572 8885.

- Relationship Manager: If your issue remains unresolved or if you have specific needs, your Relationship Manager is always available to assist you further.

For a faster resolution, kindly keep your card details ready when contacting us.

If your card is nearing its expiration date or if you need a replacement due to damage, loss, or any other reason, you’ll need to request a new card. Here’s how you can do it:

Requesting a New Card through DNBCnet Portal:

- 1. Log in to the DNBCnet portal at https://secure.dnbcnet.com/login.

- 2. On the left menu, navigate to the Card section and choose “Request new card”.

- 3. Follow the on-screen prompts to complete your new card request.

Via DNBC’s Customer Service:

- 1. Call our dedicated card support hotline at +1 604 227 7007.

- 2. Provide your account details for verification purposes.

- 3. Indicate that you wish to request a new card. Our representatives will guide you through the process and inform you of any necessary details.

Email Method:

Draft an email stating your need for a new card and send it to [email protected]. Mention essential details like your full name and account number, but refrain from sending sensitive information like the full card number.

Live Chat Assistance:

- 1. Visit the DNBC website and initiate a chat with our customer support. They can assist you with your request in real-time.

- 2. After receiving your new card, make sure to securely destroy the old one to avoid potential misuse. If your card was lost or stolen, ensure it’s suspended or deactivated before requesting a new one.

If you require assistance or encounter issues with your card, here’s how you can get in touch with DNBC:

- Email: Reach out to our Customer Service team by sending your inquiries or concerns to [email protected]. We strive to respond promptly.

- Hotline: For immediate assistance, dial our dedicated card support number at +65 6572 8885.

- Relationship Manager: If your issue remains unresolved or if you have specific needs, your Relationship Manager is always available to assist you further.

For a faster resolution, kindly keep your card details ready when contacting us.

Yes, there is a dedicated website for managing your DNBC prepaid card:

DNBCnet Portal: By accessing our web portal, you’ll have a comprehensive overview of your card transactions and settings. Simply log in through the DNBCnet website. The portal is designed for a secure and user-friendly card management experience.

In the unfortunate event that your card goes missing or is stolen, it’s essential to act quickly to safeguard your funds:

Immediate Self-Service: To ensure immediate security, we highly recommend using the DNBCnet portal to utilize the “Suspend Card” feature, which will deactivate your card instantly.

Contact DNBC: If needed, you can also reach out to us directly via our hotline or email. However, please be aware of potential timezone differences that might cause delays. Therefore, we strongly advise suspending your card immediately through the self-service option on DNBCnet.

Your financial security is our priority, so take swift action to ensure the safety of your funds.

No, the card balance operates independently and is not directly linked to your DNBC account. If you exhaust the funds on your card, you have to top it up to use it. The specific top-up procedure is as follows:

- Log in to your account via the DNBCnet portal.

- Navigate to the ‘Top-Up’ function.

If you encounter any difficulties or have questions about topping up, please email our Customer Service team at [email protected] for assistance.

The DNBC Prepaid Card is a prepaid card issued by Intercash Limited – a fully licensed e-money institution, authorized by the FCA UK, which provides end-to-end solutions of card issuance for DNBC Financial Canada Limited. The amount of money in the Client's Card Account shall be held in DNBC Financial Canada Limited’s Master Account. DNBC Financial Canada is not a bank, thus does not itself provide credit cards, take deposits, nor offer interest for the fund.

DNBC Prepaid Card is issued by Intercash Limited pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circle design is a trademark of Mastercard International Incorporated, meaning that the Card could be used wherever Mastercard is accepted. Intercash Limited is the one who makes decisions on the approval for cardholder onboarding and will be fully responsible for the amount of money being topped up to the Client’s Card Account. DNBC Financial Canada Limited does not hold the responsibility to manage this fund and the Client must monitor the transactions and control the risk themselves through DNBCnet. See DNBC Prepaid Card Agreement for more details.